PayPal has been the parent company of Venmo since 2012, so you might expect the two apps to be well integrated with each other.

But in reality, they aren’t integrated at all.

Venmo makes it clear in their Payments & Requests FAQ::

Question – Can I connect Venmo to my PayPal account to transfer money between the two?

Answer – No. Venmo is a service of PayPal, Inc., but we don’t offer the ability to transfer money between Venmo and PayPal accounts.

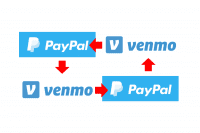

How to Transfer Funds from PayPal to Venmo

While Venmo and PayPal don’t offer a way to transfer from one to the other, it can still be done. We just have to go the long way around.

Method 1 – use a bank account that is linked to both

For this method, you would need to have a bank account that is linked to both Venmo and PayPal

On PayPal, you would withdraw funds to your bank account. PayPal offers an instant transfer for a fee, or a free transfer that takes two to three days.

Once those funds are in your bank account, you would go to your Venmo app and add funds from your bank account.

Method 2 – use your PayPal debit card, add cash to your bank account, transfer to Venmo

With this method, you withdraw cash from an ATM using your PayPal debit card, deposit the money into your bank account that’s linked to Venmo, and then go to you Venmo app and add funds from your bank account.

A couple of gotchas to keep in mind:

- Adding funds from your bank account to Venmo will probably take several days, though a limited number of Venmo users qualify for instant transfers.

- You’ll need to apply and receive a Venmo debit card before you can add funds from your bank account. That’s one of their requirements.

- The withdraw limit on your PayPal debit card is $400/day.

- ATM fees apply at most ATMs, though you can use any MoneyPass ATM for free (location lookup).

How to Transfer Funds from Venmo to PayPal

For the most part, the first two methods are similar to the above.

But when moving money from Venmo to PayPal, there’s one additional option.

Method 1 – use a bank account that is linked to both

Both Venmo and PayPal would need to be linked to the same bank account.

On Venmo, you withdraw funds to your bank account. Venmo offers an instant transfer for a fee, or a free transfer that takes two to three days.

Once those funds are in your bank account, you would go to PayPal and add funds from your bank account.

Method 2 – use your Venmo debit card, add cash to your bank account, transfer to PayPal

You would withdraw cash from an ATM using your Venmo debit card, deposit the money into your bank account that’s linked to PayPal, and then go to PayPal and add funds from your bank account.

Method 3 – get cash from your Venmo debit card, add cash to your PayPal Cash Card

This is the fastest way to move money from Venmo to PayPal.

You’ll need both a Venmo debit card and a PayPal Cash (debit) Card to take advantage of this option.

First, use your Venmo debit card at an ATM to withdraw the money you want to move.

Next, add the money to your PayPal account using your PayPal Cash Card at a participating store.

Participating stores include CVS, Dollar General, Dollar Tree, Family Dollar, Rite Aid, 7-Eleven, Walgreens and Wal-Mart stores.

You simply go to the cashier and let them know you want to load funds onto your PayPal Cash Card.

When you load the cash onto your PayPal Cash Card, it shows up in your PayPal account instantly.

So, assuming you have both Venmo and PayPal debit cards – the fastest way to move money from Venmo to PayPal would be to pull the cash out of your Venmo account through an ATM, and add it to your PayPal account through your PayPal Cash Card.

Do be aware that you will need to have a PayPal Balance Account to get a PayPal Cash Card and to carry a balance on your PayPal account.

The gotchas:

- Adding funds from your bank account to PayPal will usually take several days.

- The withdraw limit on the Venmo debit card is $400/day.

- The cash load limit on the PayPal Cash Card is $1500/day.

- PayPal does not charge a fee for adding funds through their Cash Card, but individual stores may charge a fee.

- ATM fees apply at most ATMs, though you can use any MoneyPass ATM for free (location lookup).

Eventually you’d have to think Venmo and PayPal would come up with an easy way to transfer money between the two.

Until then, workarounds will have to do.